Ron Mori

AARP endorses the bipartisan Credit for Caring Act introduced in the U.S. Senate and the U.S. House of Representatives this month, and it commends the sponsors. This bill would give a federal tax credit of up to $3,000 annually to eligible family caregivers.

The Credit for Caring Act was introduced in the Senate (S. 1443) by Senators Joni Ernst (R-IA), Michael Bennet (D-CO), Shelley Moore Capito (R-WV), Elizabeth Warren (D-MA), Tammy Baldwin (D-WI), Angus King (I-ME), Richard Blumenthal (D-CT), Jon Tester (D-MT) and Chris Coons (D-DE), and in the House (H.R. 2730) by Representatives Linda Sánchez (D-CA) and Tom Reed (R-NY).

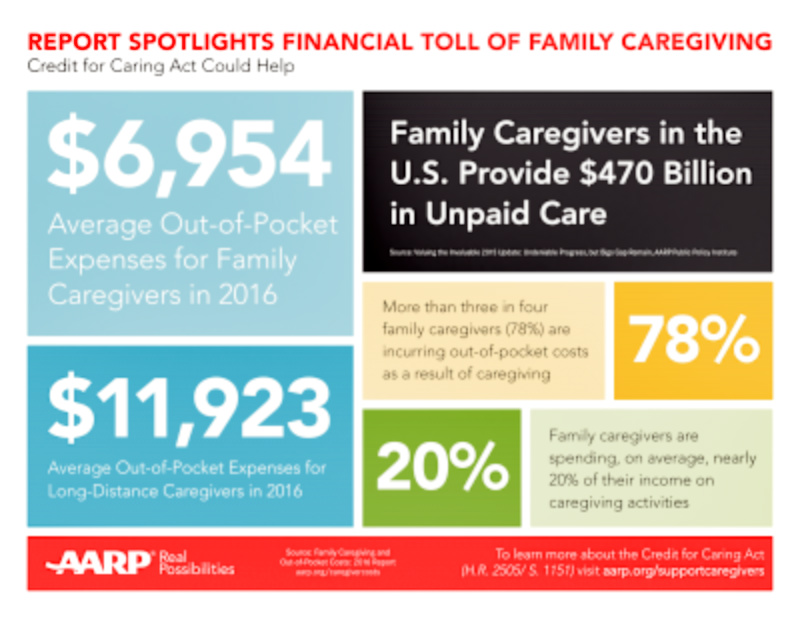

Caregiving is costly both in terms of direct expenses and potential income and retirement savings foregone.

Family caregivers spent nearly 20 percent of their income, on average, in 2016 providing care for an adult relative or friend. This equates to $6,954 paid out-of-pocket on caregiving expenses such as home modifications, care at home and transportation. Long-distance caregivers averaged $11,923 in annual expenses.

Paying for caregiving expenses can mean using savings, cutting back on the caregiver’s own health care or reducing or stopping saving for retirement.

Employed family caregivers can also lose income if they leave the workforce or cut back their hours. Leaving the workforce can mean lost job security and career mobility, employment benefits and retirement savings.

Estimates of lifetime income-related losses sustained by family caregivers age 50 and over who leave the workforce to care for a parent range from a total of $283,716 for men to $324,044 for women, or $303,880 on average, in lost income and benefits over a caregiver’s lifetime.

“Many family caregivers are using their own life savings, cutting back on personal spending, setting aside less for retirement or taking out loans to help loved ones live independently,” said AARP Chief Advocacy and Engagement Officer Nancy LeaMond. “The Credit for Caring Act would help with the financial struggles experienced by millions of caregivers, and we urge Congress to pass it.”

The Credit for Caring Act provides some financial relief by helping with the cost of in-home care, adult day care, respite care and other services. The bill would give eligible family caregivers the opportunity to receive an annual tax credit for 30 percent of qualified expenses above $2,000 paid to help a loved one, up to a maximum credit of $3,000.

About 40 million family caregivers across the U.S. provide 37 billion hours of unpaid care, valued at an estimated $470 billion annually. By helping older adults and people with disabilities live independently in their homes and communities, caregivers help save taxpayer dollars by preventing more costly nursing home care and avoiding unnecessary hospital stays.

More than three quarters (78 percent) of family caregivers pay out-of-pocket to provide care for their loved ones, spending an average of nearly 20 percent of their annual income in 2016, according to an AARP Research report. This equals roughly $7,000 each year in out-of-pocket costs related to caregiving expenses. Long-distance family caregivers spent an average of nearly $12,000.

A strong majority (87 percent) of likely voters age 50 and older support a tax credit for working family caregivers, according to an AARP poll.

Let’s all contact our lawmakers to ask them to support this bill. It’s a common-sense, bipartisan law that would help a lot of Americans who face the challenges of caregiving for loved ones!

Ron Mori is a member of the Washington, D.C., JACL chapter and manager of community, states and national affairs — multicultural leadership for AARP.